Step into the realm of H5521 360 04 – local ppo, where healthcare meets personalized coverage. This comprehensive guide unravels the intricacies of this plan, empowering you with knowledge to make informed decisions about your health and well-being.

Delve into the details of H5521 360 04, exploring its eligibility criteria, provider network, costs, and coverage. Discover the seamless process for submitting claims and accessing your benefits. Dive into the depths of customer service options, ensuring you have the support you need every step of the way.

Overview of Local PPO (H5521 360 04)

Local PPO (H5521 360 04) is a type of health insurance plan that offers coverage for medical expenses within a specific geographic area. It is designed to provide affordable healthcare options to individuals and families in local communities.

H5521 360 04 provides comprehensive coverage for a wide range of medical services, including doctor’s visits, hospital stays, surgeries, and prescription drugs. It also offers preventive care benefits, such as annual physicals and screenings, to help members stay healthy and avoid costly medical expenses in the future.

Coverage and Benefits

The coverage and benefits offered under H5521 360 04 vary depending on the specific plan chosen. However, all plans include the following essential benefits:

- Doctor’s visits

- Hospital stays

- Surgeries

- Prescription drugs

- Preventive care

Some plans may also offer additional benefits, such as dental and vision coverage, mental health services, and chiropractic care.

To improve your understanding of the h5521 360 04 – local ppo, consider reviewing the ap statistics unit 1 frq for additional insights. This resource provides valuable information that can help you grasp the complexities of h5521 360 04 – local ppo more effectively.

Eligibility and Enrollment

Eligibility for H5521 360 04 is determined by several factors, including age, income, and residency. To be eligible, you must meet the following criteria:

- Be at least 65 years of age

- Be a United States citizen or permanent resident

- Have income below a certain threshold

- Reside in a state that has opted into the H5521 360 04 program

The enrollment process for H5521 360 04 is relatively straightforward. You can enroll online, by phone, or through the mail. You will need to provide your personal information, income information, and proof of residency. Once you are enrolled, you will receive a welcome packet that includes your member ID card and information about your benefits.

Enrollment Requirements

In addition to the eligibility criteria, there are a few other requirements that you must meet in order to enroll in H5521 360 04. These requirements include:

- You must not be currently enrolled in another Medicare Part D plan

- You must not have been disenrolled from a Medicare Part D plan for any reason other than non-payment of premiums

- You must not have any outstanding debts to Medicare

If you meet all of the eligibility and enrollment requirements, you can enroll in H5521 360 04 today. To learn more about the program and to enroll, visit the H5521 360 04 website or call 1-800-MEDICARE (1-800-633-4227).

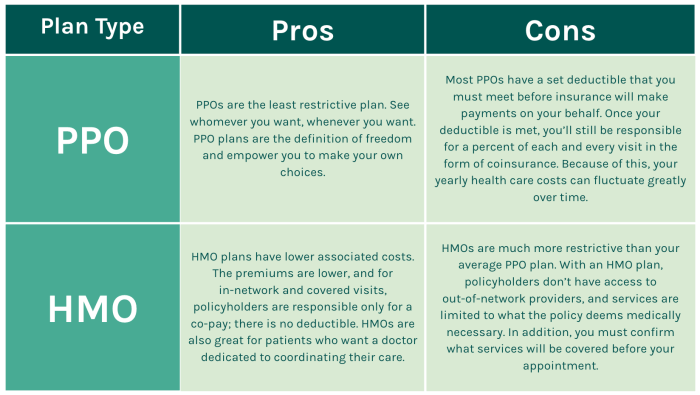

Provider Network and Access

H5521 360 04 offers a comprehensive provider network, including both in-network and out-of-network providers. In-network providers have contracted with the plan to provide covered services at negotiated rates. Out-of-network providers have not contracted with the plan and may charge higher fees.

Accessing In-Network Providers

To access in-network providers, you can use the plan’s provider directory or website to find a provider in your area. You can also call the plan’s customer service number to get assistance in finding a provider. When you visit an in-network provider, you will typically pay a lower copayment or coinsurance than you would for an out-of-network provider.

Accessing Out-of-Network Providers

You can also access out-of-network providers if necessary. However, you will typically pay a higher copayment or coinsurance for out-of-network services. You may also need to obtain a referral from your primary care physician before seeing an out-of-network provider.

Costs and Coverage

Understanding the financial aspects of H5521 360 04 is crucial for making informed decisions. This section provides an overview of the premiums, deductibles, copayments, and coverage details associated with this plan.

It’s important to note that the specific costs and coverage may vary depending on factors such as your age, location, and health status. Contact your insurance provider or visit their website for personalized information.

Premiums

Premiums are the regular payments you make to maintain your health insurance coverage. H5521 360 04 offers different premium options to cater to various budgets and needs. The premiums are typically paid monthly, quarterly, or annually.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage begins. H5521 360 04 has a deductible that applies to certain covered services. Once you meet your deductible, your insurance will start covering a portion of the costs.

Copayments

Copayments are fixed amounts you pay for certain covered services, such as doctor’s visits or prescription drugs. H5521 360 04 has copayments for specific services. Copayments are typically lower than the actual cost of the service.

Coverage Limitations and Exclusions

While H5521 360 04 provides comprehensive coverage, there are certain limitations and exclusions. These may include:

- Services not deemed medically necessary

- Cosmetic procedures

- Experimental treatments

- Pre-existing conditions (in some cases)

Utilization and Claims

H5521 360 04 offers a streamlined process for submitting claims and accessing claims history. Here’s an overview of the process:

To submit a claim, you can either mail it to the address provided on your insurance card or submit it electronically through the provider’s online portal. Ensure you have all the necessary documentation, including the claim form, medical records, and receipts.

Tracking Claims and Benefits, H5521 360 04 – local ppo

You can track the status of your claims and view your benefits history through the provider’s online portal. The portal allows you to view the progress of your claims, check the status of payments, and access information about your coverage.

Customer Service and Support: H5521 360 04 – Local Ppo

H5521 360 04 members have access to a comprehensive customer service system designed to provide support and assistance whenever needed.

Members can contact customer service through various channels, including phone, email, and online chat. The customer service team is available 24/7 to assist with a wide range of inquiries, including coverage questions, claim submissions, and provider network information.

Phone Support

Members can call the customer service hotline at [phone number] to speak directly with a representative. The hotline is open 24 hours a day, 7 days a week.

Email Support

Members can send an email to [email address] with their inquiries. The customer service team will respond to emails within 24 hours.

Online Chat Support

Members can access online chat support by logging into their member portal on the H5521 360 04 website. The online chat service is available during business hours.

Top FAQs

What sets H5521 360 04 apart from other PPO plans?

H5521 360 04 is tailored specifically to meet the unique healthcare needs of your local community, providing access to a comprehensive network of providers and tailored coverage options.

How do I determine if I am eligible for H5521 360 04?

Eligibility criteria vary depending on factors such as age, residency, and income. Contact your local healthcare provider or insurance agent to inquire about your specific eligibility.

What is the process for submitting a claim under H5521 360 04?

Submitting a claim is simple and straightforward. You can submit claims online, through the mail, or by phone. Detailed instructions and support are available to guide you through the process.