Reading a pay stub worksheet can seem like a daunting task, but it’s essential for understanding your earnings and deductions. This comprehensive guide will provide you with the tools you need to decipher your pay stub and ensure you’re getting the most out of your paycheck.

In this guide, we’ll cover everything from understanding gross income to calculating net income. We’ll also discuss common deductions, pay frequencies, and other important information found on a pay stub. By the end, you’ll be a pay stub pro, able to confidently manage your finances and make informed decisions about your income.

Understanding a Pay Stub

A pay stub is an essential document that provides a detailed breakdown of your earnings and deductions for a specific pay period. It serves as a record of your compensation and helps you track your financial situation.

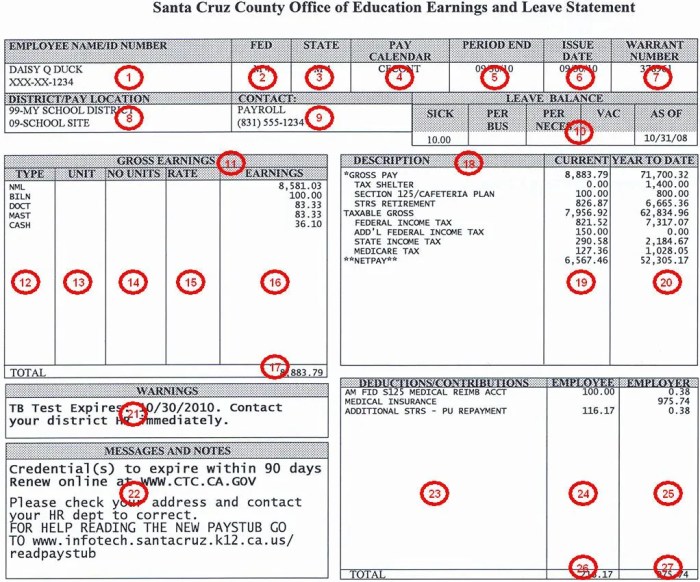

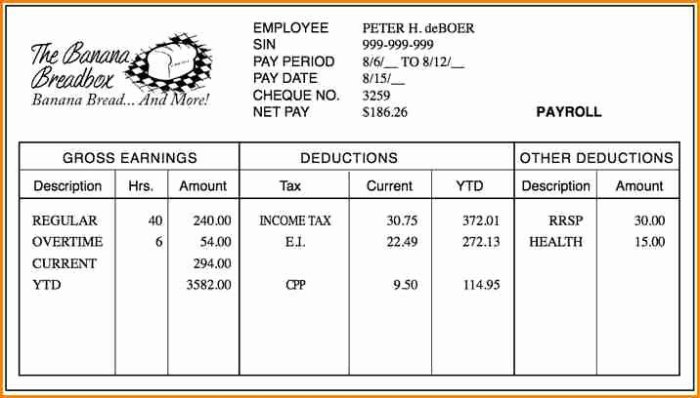

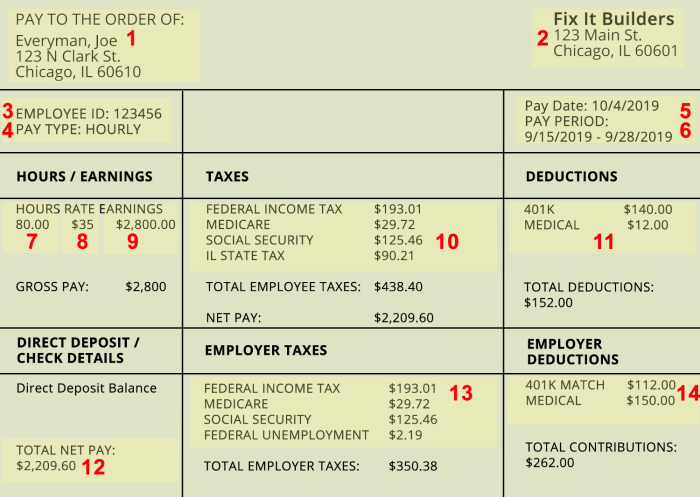

Common Sections and Information on a Pay Stub, Reading a pay stub worksheet

Pay stubs typically include the following sections and information:

- Personal Information: Name, address, employee ID

- Pay Period: Start and end dates of the pay period

- Gross Pay: Total earnings before deductions

- Earnings: Wages, overtime, bonuses, commissions

- Deductions: Taxes (federal, state, local), Social Security, Medicare, health insurance, retirement contributions

- Net Pay: Amount of money deposited into your bank account

- YTD Information: Year-to-date totals of earnings and deductions

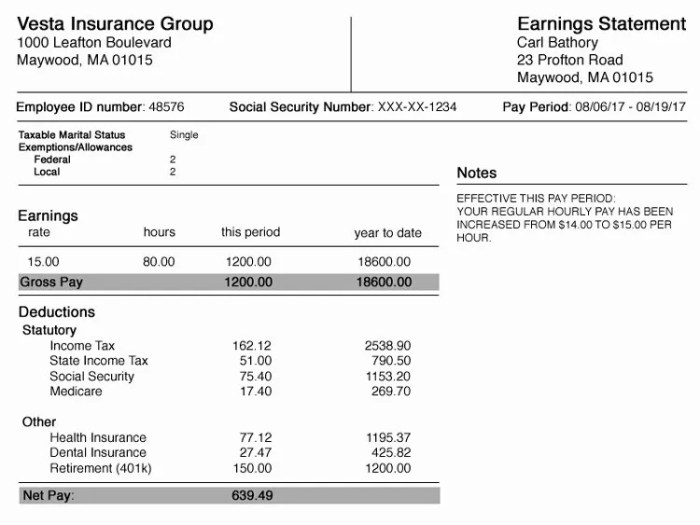

Analyzing Gross Income

Gross income represents your total earnings before any deductions are taken out. It’s the starting point for calculating your net pay, which is the amount you actually receive after taxes and other deductions.To calculate gross income from a pay stub, simply add up all the earnings listed in the “Earnings” section.

This typically includes wages, salaries, bonuses, commissions, and any other forms of compensation.Keep in mind that gross income can be reduced by certain deductions. These deductions are typically taken out before your net pay is calculated and may include taxes, health insurance premiums, retirement contributions, and other voluntary deductions.

Understanding Deductions: Reading A Pay Stub Worksheet

Deductions are amounts subtracted from your gross income before calculating your take-home pay. They can be categorized into two types: pre-tax and post-tax.

Pre-tax deductions are subtracted from your gross income before taxes are calculated. Common pre-tax deductions include:

- Health insurance premiums

- 401(k) contributions

- Flexible spending accounts (FSAs)

Post-tax deductions are subtracted from your gross income after taxes are calculated. Common post-tax deductions include:

- Dental insurance premiums

- Vision insurance premiums

- Life insurance premiums

Deductions can significantly impact your take-home pay. Pre-tax deductions reduce your taxable income, which can result in lower taxes and a higher take-home pay. Post-tax deductions, on the other hand, do not reduce your taxable income, so they have a direct impact on your take-home pay.

Navigating a pay stub worksheet can sometimes lead to more questions than answers. To delve deeper into personal finance and uncover insights beyond the surface, explore the “let’s get deep questions pdf” here . Returning to the pay stub worksheet, remember that understanding your deductions and benefits is crucial for making informed financial decisions.

Calculating Net Income

Net income, also known as “take-home pay,” represents the amount of money an employee receives after deductions have been taken from their gross income. Unlike gross income, which includes all earnings before taxes and other withholdings, net income reflects the actual amount an employee has available to spend or save.

Step-by-Step Guide to Calculating Net Income

- Start with your gross income, which is the total amount earned before any deductions.

- Subtract any pre-tax deductions, such as health insurance premiums, retirement contributions, and union dues.

- Calculate your taxable income by subtracting pre-tax deductions from your gross income.

- Apply applicable taxes, including federal income tax, state income tax, and FICA (Social Security and Medicare taxes), to your taxable income.

- Subtract the calculated taxes from your taxable income to arrive at your net income.

Factors Affecting Net Income

- Gross income:Higher gross income typically results in higher net income.

- Pre-tax deductions:Choosing higher pre-tax deductions can reduce your taxable income and increase your net income.

- Tax bracket:The tax bracket you fall into determines the percentage of your income that is taxed.

- Dependents:Having dependents can reduce your taxable income and increase your net income due to tax credits and deductions.

Understanding Pay Frequency

Pay frequency refers to the regular intervals at which an employee is paid their wages or salary. Common pay frequencies include weekly, bi-weekly (every two weeks), semi-monthly (twice a month), and monthly.

Impact on Net Income

The pay frequency can affect the amount of net income an employee receives each pay period. For example, an employee paid weekly will receive smaller paychecks but more frequent payments than an employee paid monthly. This can impact budgeting and financial planning.

Adjusting Calculations

To accurately calculate net income based on pay frequency, adjustments may be necessary. For example, to calculate monthly net income from weekly paychecks, multiply the weekly net income by the number of weeks in a month.

Example: Weekly net income = $400Monthly net income = $400 x 4 (weeks in a month) = $1,600

Conversely, to calculate weekly net income from monthly paychecks, divide the monthly net income by the number of weeks in a month.

Example: Monthly net income = $1,600Weekly net income = $1,600 / 4 (weeks in a month) = $400

Additional Considerations

Understanding other information on your pay stub, such as benefits, overtime, and taxes, is crucial for financial planning and managing your finances effectively.

Additionally, reviewing your pay stubs regularly helps ensure accuracy and allows you to identify any discrepancies or errors that may require attention.

Benefits

Your pay stub may include details about benefits offered by your employer, such as health insurance, retirement plans, and paid time off. Understanding these benefits is essential for making informed decisions about your financial well-being.

Overtime

If you work hours beyond your regular schedule, your pay stub should reflect any overtime pay you’re entitled to. Overtime pay is typically calculated at a higher rate than your regular pay, and it’s important to ensure you’re being compensated fairly for any overtime hours worked.

Taxes

Your pay stub will show the various taxes withheld from your paycheck, including federal income tax, Social Security tax, and Medicare tax. Understanding how these taxes are calculated and how they impact your net pay is essential for financial planning.

Tips for Understanding and Managing Pay Stubs Effectively

- Familiarize yourself with the different sections and information included on your pay stub.

- Keep a record of your pay stubs for reference and to track your income over time.

- If you have any questions or concerns about your pay stub, don’t hesitate to reach out to your employer or payroll department for clarification.

- Use your pay stub information to create a budget and track your expenses to ensure you’re managing your finances effectively.

Importance of Reviewing Pay Stubs Regularly

- Ensures accuracy and identifies any errors or discrepancies.

- Provides a record of your income and deductions for tax purposes.

- Helps you understand your financial situation and make informed decisions about your finances.

FAQ Resource

What is a pay stub?

A pay stub is a document that provides a detailed breakdown of your earnings, deductions, and other information related to your paycheck.

What are the common sections found on a pay stub?

Common sections on a pay stub include gross income, deductions, net income, pay frequency, and taxes.

What are the different types of deductions?

There are two main types of deductions: pre-tax deductions and post-tax deductions. Pre-tax deductions are taken out of your gross income before taxes are calculated, while post-tax deductions are taken out of your net income after taxes have been calculated.

How do I calculate my net income?

To calculate your net income, you need to subtract your deductions from your gross income.

What is pay frequency?

Pay frequency refers to how often you are paid, such as weekly, bi-weekly, or monthly.