Suppose the government imposes a tax of P: this premise sets the stage for an in-depth exploration of the economic consequences that arise from such a fiscal policy. By examining tax incidence, efficiency, revenue generation, administration, and broader economic impacts, this analysis unravels the complexities associated with government taxation.

The ensuing paragraphs delve into the intricacies of tax incidence, shedding light on how the tax burden is distributed among consumers and producers. The concept of tax shifting and its implications are meticulously examined, providing valuable insights into the dynamic interplay between market participants.

Tax Incidence

A tax is a compulsory levy imposed by the government on individuals or businesses to raise revenue for public purposes. The tax burden is distributed among consumers and producers in various ways, depending on the tax structure and market conditions.

Tax shifting occurs when the burden of a tax is passed on from the party legally responsible for paying it to another party. For instance, a producer may increase prices to offset the cost of a sales tax, effectively shifting the tax burden to consumers.

Tax incidence can significantly impact market participants. Consumers may reduce their consumption of taxed goods or services, while producers may adjust production levels or seek alternative tax-advantaged activities.

Tax Efficiency

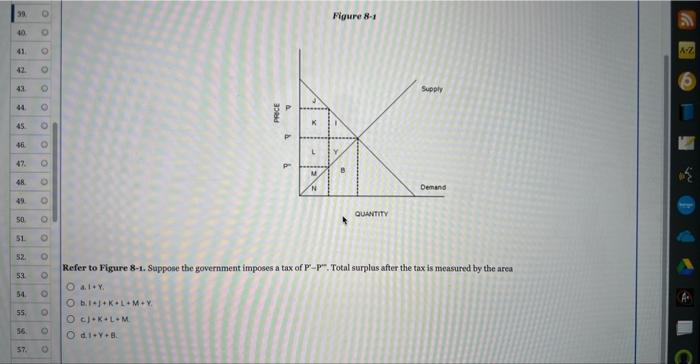

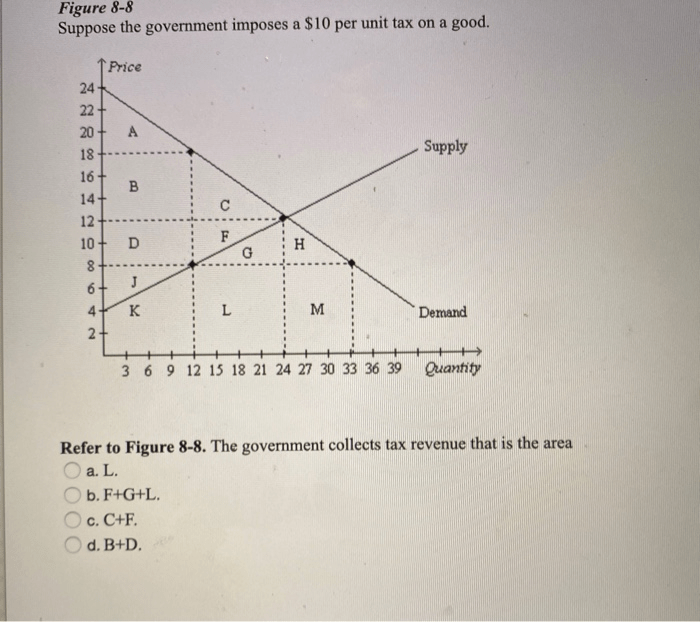

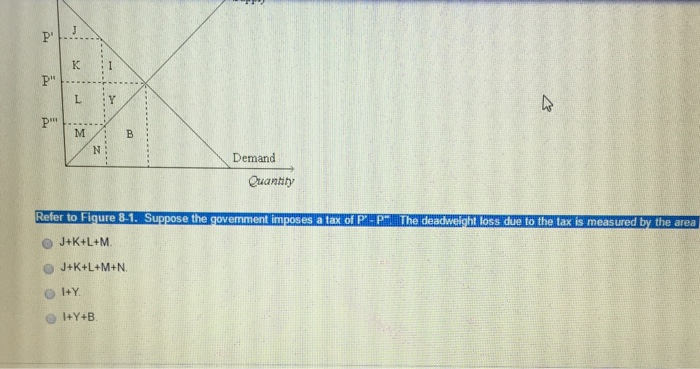

Taxes can affect economic efficiency by creating distortions in the market. Deadweight loss, a measure of the reduction in economic welfare caused by a tax, occurs when the tax alters market outcomes and leads to inefficient resource allocation.

Taxes can discourage investment and innovation, reduce consumer surplus, and distort producer incentives. Understanding the efficiency implications of taxes is crucial for policymakers to design tax systems that minimize economic distortions.

Tax Revenue

The potential revenue generated by a tax depends on various factors, including the tax base, tax rate, and economic conditions. Accurately estimating tax revenue is essential for government budgeting and planning.

Factors such as tax avoidance, evasion, and economic fluctuations can influence the actual revenue collected. Governments must consider these factors when designing tax policies to ensure sufficient revenue generation.

Tax Administration: Suppose The Government Imposes A Tax Of P

Tax administration involves the implementation and enforcement of tax laws. Administrative costs associated with tax collection include the cost of tax agencies, tax audits, and compliance activities.

Efficient and effective tax administration is crucial to minimize tax evasion, ensure compliance, and reduce the burden on taxpayers. Governments must implement robust tax administration systems to maximize revenue collection and maintain public trust.

Economic Impact

Taxes can have broader economic effects beyond revenue generation. They can influence investment, employment, and economic growth.

Taxes may discourage investment by reducing the expected returns on investment. Additionally, taxes can affect employment levels by altering labor costs and incentives to work. The overall economic impact of a tax depends on its design and the specific economic context.

Policy Implications

Policymakers must carefully consider the trade-offs between revenue generation and economic efficiency when designing tax policies.

To mitigate negative impacts and enhance the effectiveness of taxes, policymakers can implement measures such as tax exemptions, tax credits, and targeted tax rates. Effective tax policy balances revenue needs with the promotion of economic growth and social equity.

Clarifying Questions

What is tax incidence?

Tax incidence refers to the distribution of the tax burden among different economic agents, such as consumers, producers, and landowners.

How does tax shifting affect market outcomes?

Tax shifting occurs when the initial bearer of a tax passes on the burden to another party, potentially leading to distortions in market prices and consumption patterns.

What is deadweight loss in the context of taxation?

Deadweight loss refers to the reduction in economic efficiency caused by taxation, resulting in a net loss of consumer and producer surplus.